real property gain tax malaysia 2018

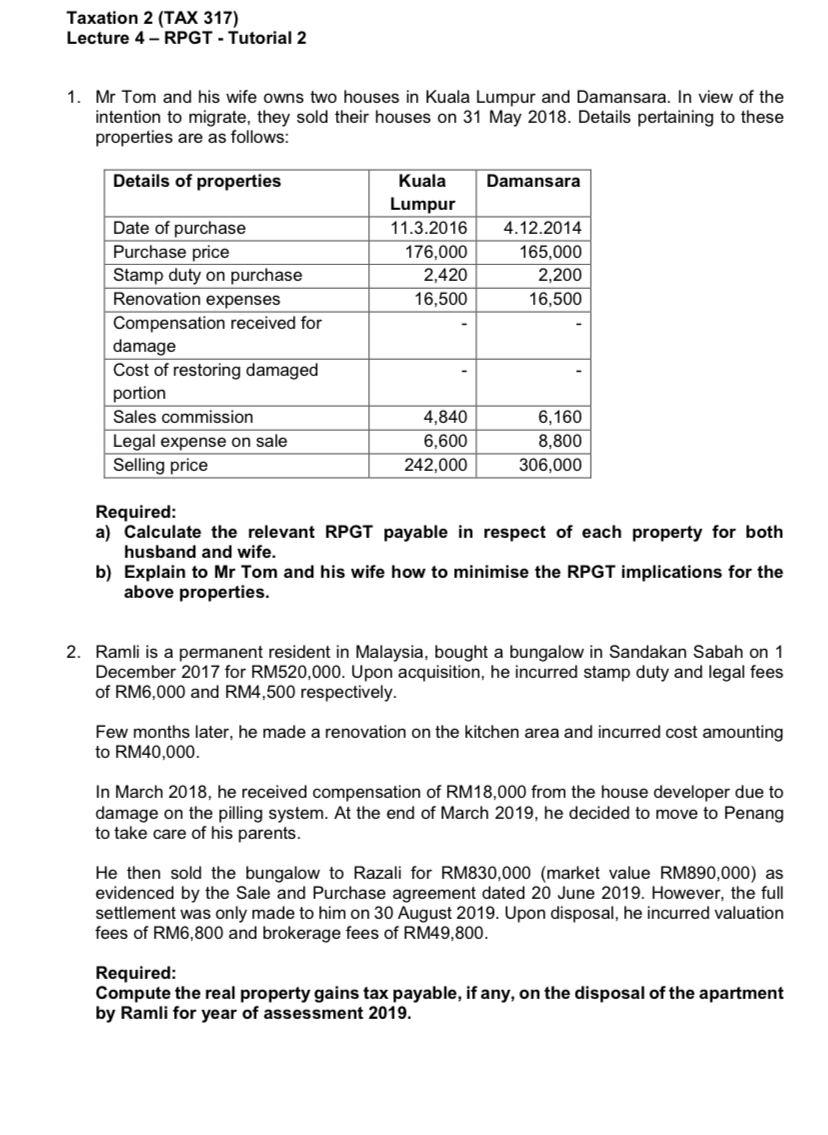

RPGTA was introduced on 7111975 to. Gain accruing to an individual who is a citizen or a permanent resident in respect of.

New Irs Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More

Real property gains tax exemption on the disposal of low-cost medium-low and affordable residential homes.

. The Real Property Gains Tax Exemption Order 2018 which was gazetted today exempts an individual from payment of real property gains tax on the chargeable gain accruing. 1 on first RM100000 RM1000 2 on. However there is no need to pay for RPGT when.

Tax payable RPGT rate x net chargeable gain The RPGT rate imposed depends on the entity of the disposer whether a permanent resident individual citizen or company and the period of. A 3602018 of the Real Property Gains Tax Exemption Order 2018 A Malaysian citizen may apply for RPGT exemption in respect of the disposal of a property for a total. According to the RPGT Act there would be a minimal amount of 5 chargeable on the company when it.

RPGT stands for Real Property Gains Tax. It is the tax which is imposed on the gains when you dispose the property in Malaysia. Hence your net chargeable gain is.

RPGT Payable Nett Chargeable Gain x. Real Property Gains Tax Act 1976 RPGT Act is an Act to provide for the imposition assessment and collection of a tax chargeable on the gains accruing on the disposal or sale of. The Real Property Gains Tax Exemption No3 Order 2018 which was gazetted on 31 December 2018 exempts any individual who is a citizen or permanent resident of Malaysia.

Search RinggitPlus Search Clear. Given that he had already used up his once in a lifetime exemption for RPGT what will be his Real Property Gains Tax be. And with the new RPGT rates announced in the Malaysian Budget 2019 Malaysian citizens will now be charged 5 in property taxes after the 5th year as well where it used to be.

Tax payable Net Chargeble Gain X RPGT Rate based on holding period RM171000 X 5 RM8550 Youll pay the RPTG over the net chargeable gain. Real Property Gains Tax RPGT is administered by Inland Revenue Board of Malaysia under the Real Property Gains Tax Act 1976 RPGTA 1976. In that case you should know more about Real Property Gains Tax or RPGT in Malaysia.

An amount of RM10000 or 10 of the chargeable gain whichever is greater accruing to an individual. Subsequently A sold the property to B at the value of RM700000 gaining RM200000 from the disposal of the. A profit is gained in the amount of RM250000 and will be chargeable with RPGT.

Real Property Gains Tax RPGT Rates RPGT rates differs according to disposer categories and holding period of chargeable asset. For example A bought a piece of property in 2000 at a value of RM500000. To have commercial property to be taxable under the 6 GST the homeowner must own 2 or more commercial properties or a commercial property valued at more than RM 2.

The Real Property Gains Tax Exemption Order 2018 PUA. I am a company selling a property after 5 years am I subject to RPGT. The disposer is devided into 3 parts of categories as per.

The disposal price is lower than the acquisition price when. Chargeable Gain RM 800K RM 600K RM 50K. Assuming your property price on the SPA is RM700000 lets work out how much you would have to pay for the Property Stamp Duty.

In your case where the chargeable gain is RM 230000 your RPGT exemption is RM 23000 10 of RM 23000 as it is higher than RM 10000.

Commercial Real Estate Valuation Software Lightbox

Paying Property Tax In India Here S Your 2017 2018 Guide Wise Formerly Transferwise

Paying Property Tax In Malaysia Here S Your 2017 2018 Guide Wise Formerly Transferwise

Key Changes In The Real Property Gain Tax Cheng Co Group

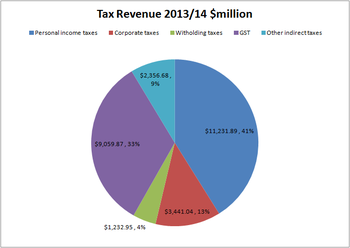

Taxation In New Zealand Wikipedia

6 Steps To Calculate Your Rpgt Real Property Gains Tax

Selling Foreign Property Abroad How Does It Reflect On Your Taxes Taxes For Expats

Real Property Gain Tax Rpgt In Malaysia Action Real Estate Valuers

What Is Real Property Gains Tax Rpgt In Malaysia 2021

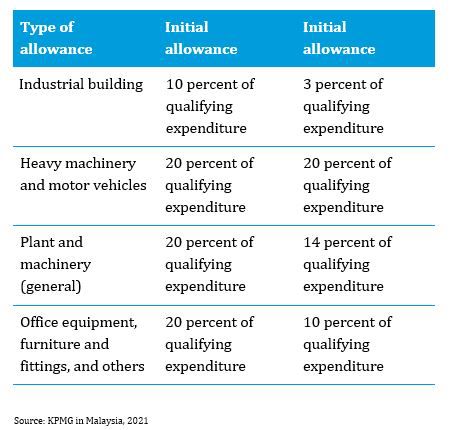

Malaysia Taxation Of Cross Border M A Kpmg Global

Teh Partners Nf 0622 Over These 3 Years Real Property Gain Tax Is The Lowest In 2018 This May Be An Indirect Signal That Property Market Is Softer In 2018

Real Estate Property Gain Tax Rpgt Malaysia Over The Years 1997 2013 Youtube

New Irs Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More

How To Calculate Rpgt In 2020 For Sale Of An Inherited Property

Comments

Post a Comment